NSoR 3: The Economics of Religion

An excerpt from Chapter 3 of The New Sciences of Religion: Exploring Spirituality from the Outside In and Bottom Up (Palgrave Macmillan, 2010) Pages 65 – 67.

Our second major question in this chapter is how to apply economic models to understanding religion itself. One of the first to advance such a theory was Karl Marx, who argued that religions were a product of the economic system. In Marx’s analysis, feudalism created Catholicism, and capitalism created Protestantism. Religion belongs to the superstructure, a reflection of the economic base. This theory of religion is too simplistic, most would agree today. To reverse Marx’s metaphor, religions can also be part of the base, the foundation that shapes the economic structure of a society. The directions of causation run both ways. Religion is both a dependent and independent variable in economic development.

To the extent that economic structures influence religiosity, however, we should be expecting and are witnessing dramatic changes in religion in the era of global capitalism. We are seeing the rise of consumer-driven religion in the world. Instead of investing all their spiritual resources in a single tradition, people are developing “diversified religious portfolios.” Part of the “spiritual, not religious” phenomenon is a new interest in “shopping around” for religious ideas and practices from a variety of traditions. Certainly, more people practice hatha yoga today in the United States than do so in India, but this yoga is largely disconnected from its Hindu spiritual roots. Evangelical Christians now teach Christian “yoga,” as in “Stretching for Jesus.” The Sufi mystic poet Jalal ad-Din Muhammad Rumi, as translated by Coleman Barks, is now the most popular poet in the United States, but few of his readers could tell you what the Five Pillars of Islam are. Kabbalah, the Jewish mystical tradition, has attracted non-Jewish celebrity disciples, including the rock star Madonna. New Age conferences and publications are a virtual Walmart of different esoteric practices taken from here, there, and everywhere.

Paradoxically, fundamentalism is also a response to religion in an era of global capitalism. In a time of rapid change and uncertainty, it may be more spiritually, psychologically, and sociologically comforting to have a single and rigorously defined belief system and group identity. As we will learn in the next chapter, there are advantages to belonging to a defined group, religion being one of the markers of group identity. And the stricter the group, the greater the benefits of membership tend to be. Economists use the language of “irreversible investments” to describe certain types of “religious investments.” In fact, the fastest-growing religions in the world today are Islam, Pentecostal Christianity, and amorphous New Age-type syntheses. The first two are “irreversible investments,” while the latter can be thought of as a “diversified portfolio.”

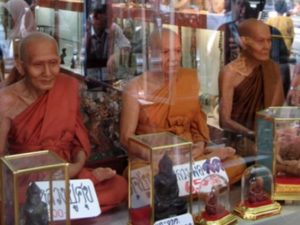

We can now talk about a global marketplace for religions. The University of Chicago economist Gary Becker has developed competitive models of religious markets. Not unlike corporations, religions seek monopolistic control over their religious markets. Adam Smith addresses this phenomenon in The Wealth of Nations and clearly favors the idea of religious competition, although he himself is not particularly religious. State religions in Europe are examples of religious monopolies, often established centuries ago. Other examples might include Islam in Iran and Saudi Arabia or perhaps Buddhism in Thailand and Sri Lanka. Becker argues that competition is good for religious markets. In those countries where there are religious monopolies, religiosity ultimately declines, as in the case of Western Europe.31 In those countries where there is healthy religious competition, such as the United States, religiosity thrives and grows.32 Historical studies in the nineteenth and early twentieth centuries also suggest that, in those countries where Catholic and Protestant missionaries competed with each other, the religious groups provided better schools and hospitals, whereas in those countries where they had monopolies, the services provided were inferior.33 In this analysis, religious competition is a good thing, and the world needs more of it. We must make sure, however, that this competition between faiths does not turn into violence, in which case all of us will be losers. Certainly, the complex mixture of churches and temples in local communities is an increasingly global phenomenon, one that we need to manage carefully and nurture in order to prevent destructive religious competition, as witnessed so often in the past.

Rational Choice Theory in Religion

Another version of the economic modeling of religion uses rational-choice theory, as promoted by Rodney Stark and others. In this view, people are making rational choices about the utility functions of religion. As with other investments or purchases, the benefits are largely a matter of perception once we get beyond the maintenance of basic biological needs. The utility function of adopting a particular religion can be eternal or merely temporal. Stark uses these insights to explain the rapid rise of Christianity in the Roman Empire.34

Now, there are a lot of problems with rational-choice theory in classical economics. It turns out to be a gross distortion of real human economic activity. Traditional economic models assume “incredibly smart people in unbelievably simple situations,” while the real world involves “believably simple people [coping] with incredibly complex situations.”35 How would one actually be an informed consumer of religion in a global marketplace? What would it mean to select “the best” religion, and how would one go about doing this? Most people are simply born into and raised in a tradition. If they become disillusioned with that tradition, they do not necessarily convert to another tradition. Sociologically, they tend to drift back to their tradition when they begin to raise children. In many cases, there are severe penalties for conversion, including social ostracism or even death in the case of strict Islamic law. So the economics of religion is not really a free market.

As already noted, we are increasingly encountering what might be called “supermarket spirituality,” in which people mix and match a little bit of this and that — yoga on Monday, AA on Tuesday, Zen on Wednesday, hedonism on Thursday, Sufism on Friday, Kabbalah on Saturday, and Unity Church on Sunday. While some of this approach may be crass and superficial, the history of all religions has involved lots of cross-fertilization, borrowing, and outright plagiarism. It is just that now the pace of this cross-fertilization is accelerating in our globalized world. Religious movements now use radio, television, and the Internet to promote themselves with the marketing acumen of Madison Avenue. Rational-choice theory is about perceived benefits, so it need not be “rational” at all, but then neither are everyday economic choices necessarily rationally self-interested. The theory, as applied to religions, however, does lead to some interesting hypotheses about the decisions of individuals and the behavior of religious movements.

Notes

31. I would argue that the religious impulse expresses itself in Western Europe in new forms like Communism and environmentalism, recalling our earlier discussion of “primary subgroup identity.”

32. Gary Becker, “Keynote,” at Spiritual Capital working group (Harvard University, 10/9/2003); Laurence R. Iannaccone, “The Economics of Religion: A Survey of Recent Work,” Journal of Economic Literature, XXXVI (September 1998) 1465-1496.

33. Robert Woodbury, “Missionary Data (1813-1968) as a Resource for Testing Religious Economies and Secularization Theory,” in Association for the Study of Religion, Economics and Culture (Rochester, NY: 11/4/2005.

34. Rodney Stark, The Rise of Christianity: How the Obscure, Marginal Jesus Movement Became the Dominant Religious Force (New York: HarperCollins, 1997).

35. As quoted by Beinhocker, Origin of Wealth, 52.